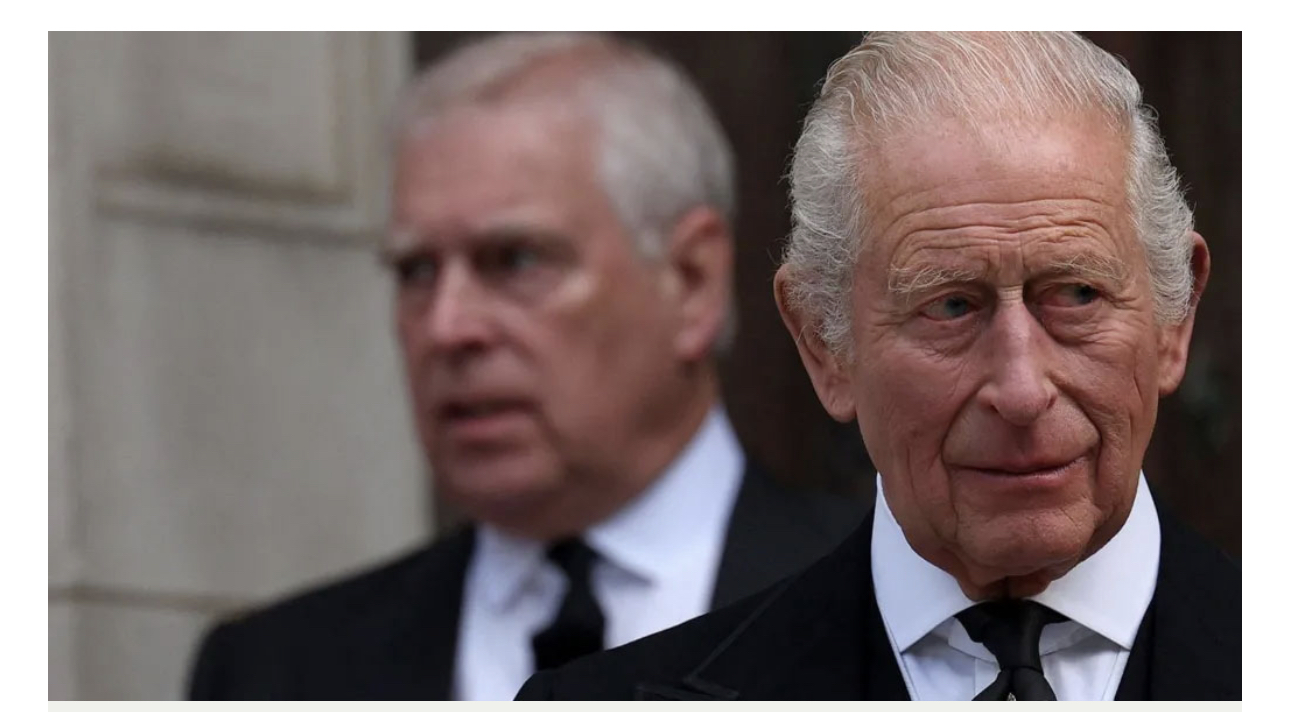

How King Charles III Funds the Monarchy and Prince Andrew’s New Life

Following the removal of his ‘Prince’ title due to a sex scandal, Prince Andrew, a member of the British Royal Family, has been forced to leave his royal residence, the ‘Royal Lodge,’ for a more private life in the countryside. King Charles III is personally funding his younger brother’s new accommodation and lifestyle.

The enormous costs associated with the monarchy, including expenses for Prince Andrew and other royal activities, naturally spark curiosity about the sources of the King’s vast wealth.

A BBC report on Friday (October 31st) provided a detailed breakdown of the British Royal Family’s income, primarily derived from public funds, known as the Sovereign Grant, though this is not King Charles’s sole source of revenue.

Sources of the King’s Income

1. The Sovereign Grant (Public Funds)

The Sovereign Grant is the annual public funding allocated to the monarchy by the government to cover official duties, travel, security, and palace maintenance.

• 2025-26 Allocation: The grant has increased to £132.1 million (approximately 2,120 crore BDT), an increase of about £45 million from the previous year.

• 2024-25 Allocation: The grant stood at £86.3 million. Of this, £51.8 million was for core royal expenditure, and £34.5 million was designated for the Buckingham Palace renovation project.

• Historical Context: When the grant was introduced in 2012, it was initially set at only £31 million per year.

2. The Crown Estate (Revenue-Generating Property)

The Sovereign Grant amount is determined based on the profits of the Crown Estate. Although the estate is owned by the monarch, it is managed independently, and its revenues are submitted to the public treasury. The Royal Family is then given a percentage of that profit.

• Value and Assets: In 2023-24, the Crown Estate’s assets were valued at approximately £15 billion, including significant holdings like London’s Regent Street and extensive coastal lands. Crucially, the King cannot personally sell or use these assets for private gain.

• Allocation Rate: The Royal Family’s allocation rate from the Crown Estate’s profits was temporarily increased to 25\% in 2017 to fund the urgent Buckingham Palace refurbishment. It has since been reduced to 12\% starting from the 2024-25 financial year. However, due to increased profits from offshore wind farms, King Charles received approximately £45 million more this year.

3. Private Estates (Duchies)

King Charles III earns income from the Duchy of Lancaster, his private estate comprising 18,000 hectares of land and various properties.

• Duchy of Lancaster: The value of this asset was £679 million as of March 2025, with an annual profit of approximately £24.4 million.

In contrast, his son, Prince William, receives income from the Duchy of Cornwall.

• Duchy of Cornwall: The estate is valued at £1.1 billion, with an annual profit of about £22.9 million.

The income from these two Duchies can be used by the King and Prince William personally, though they cannot keep the funds if the estate’s assets are sold.

4. Personal Property

Charles also privately owns estates such as Balmoral and Sandringham. It is anticipated that King Charles will allow Prince Andrew to reside at the Sandringham Estate in Norfolk.

Taxation and Overall Cost

• Tax Payment: Following Queen Elizabeth II’s decision in 1992, King Charles also voluntarily pays income tax. However, the amount paid is not disclosed to the public. The Sovereign Grant itself is not subject to tax.

• Total Cost: ‘Republic,’ a democratic organization, claims that the total annual cost to UK taxpayers for maintaining the monarchy, including security and other associated expenses, is approximately £510 million.